Core Platform Features

Powerful AI Technology

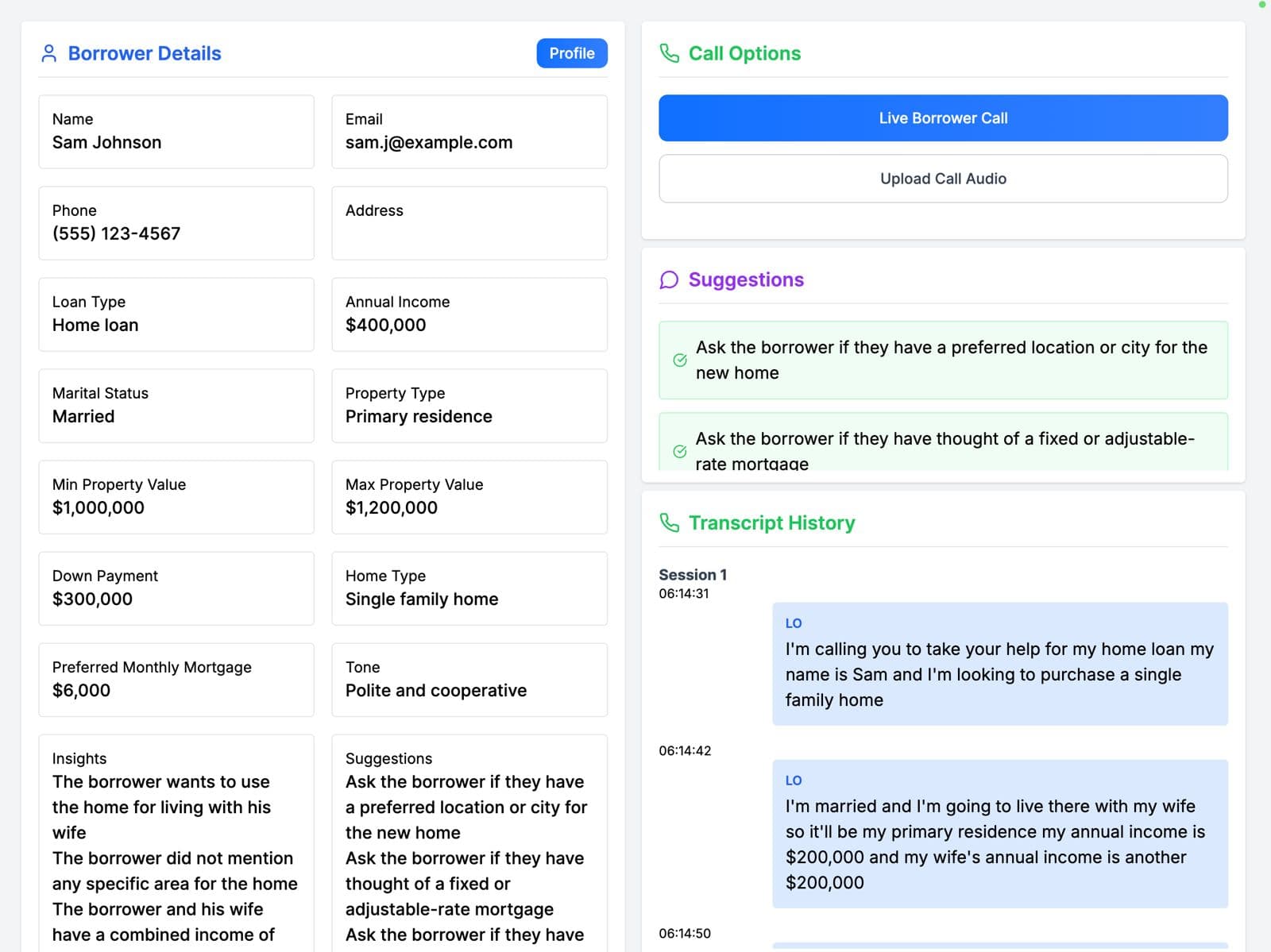

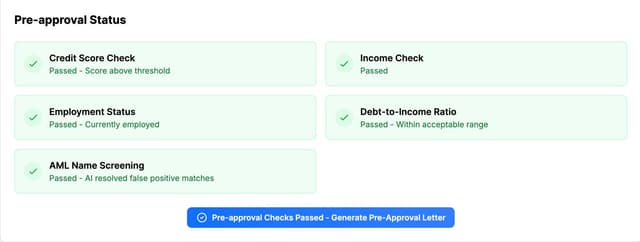

Real-Time Call Intelligence

Get instant AI-powered insights and recommendations during live borrower calls. Make data-driven decisions in real-time.

- Live call analysis and suggestions

- Instant rate and program matching

- Real-time compliance monitoring

- Smart conversation guidance

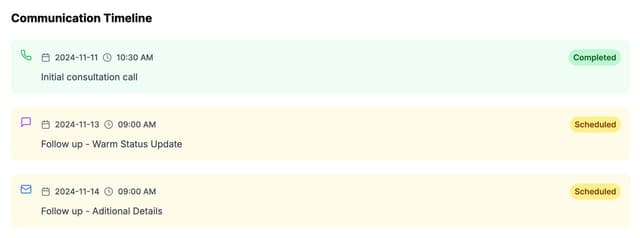

Smart Follow-up Automation

Let AI handle your follow-up strategy with personalized, multi-channel communications that convert.

- AI-driven follow-up timing

- Personalized message creation

- Multi-channel orchestration

- Engagement tracking

Performance Analytics

Understand your performance metrics and get AI-powered suggestions to improve your conversion rates.

- Conversion funnel analysis

- Call success metrics

- Performance benchmarking

- AI-powered coaching

Real Results

Transform Your Lending Business

Join successful loan officers who are using DominantCurve to revolutionize their lending practice.

Close More Loans

Increase your conversion rates by up to 40% with AI-guided conversations and perfectly timed follow-ups that keep prospects engaged throughout their journey.

Save Time Daily

Reclaim 3+ hours every day with automated follow-ups, instant loan scenario analysis, and AI-powered prioritization of your hottest leads.

Grow Revenue

Boost your monthly loan volume while reducing costs. Our users report an average 25% increase in monthly closed loans within the first 90 days.

Pricing

Flexible Pricing Plans

Start making smarter decisions

INDIVIDUAL LO

1,000/month

- Real-time call intelligence

- Automated follow-up system

- Performance analytics

- Compliance monitoring

- Visualization tools

- Email & phone support

ENTERPRISE

Custom

For 15+ loan officers

- Everything in Individual plan

- Team analytics dashboard

- Advanced compliance features

- Custom integration options

- Dedicated account manager

- Priority support

- Training and onboarding

Frequently asked questions

Don't worry, we got you. Here are some answers for your questions.